Real Property Records and Adjustments

1. When should a Real Property record be created in TRACS?

Grants with an objective strategy of "Real Property Acquisition" will require a link to a real property record in the performance report. The Real Property record should be entered into TRACS after the real property has been acquired and prior to the performance report being entered into TRACS.

2. Where can I enter a Real Property record in TRACS?

A Real Property record is created under the "Inventory" module by selecting "Real Property". The Inventory module used by grantors and grant recipients to create, adjust, manage, approve and monitor real property and facility records pertaining to acquisition or disposal actions which serve a grant purpose and therefore have a Federal nexus.

3. What is a Real Property Adjustment?

A Real Property Adjustment is an adjustment that can be made to an approved base real property record to document an acreage adjustment, boundary adjustment, change in purpose, disposal or encumbrance modification.

4. Are legacy federal and state Real Property records available in TRACS?

Yes, the Lands team will be reconciling legacy federal and state land records for ingestion into TRACS. It is up to regions to determine which records will be a part of the legacy data uploads and which records will need to be entered directly into TRACS.

5. Do we need to include any changes to the properties we already own that occur after Jan 1, 2021?

Yes, substantive changes to all properties in TRACS (including records from before Jan. 1 2021) should be captured as adjustments, as defined by the different adjustment types available (e.g. disposal, partial disposal, change in purpose, change in boundary, change in location, etc.). Adjustments are intended to reflect changes to the original record that occur over time. Please work with your Regional Office for additional guidance.

6. Does the appraisal valuation go thru the Office of Appraisal & Valuation Services?

It is not required. Regions typically require State grantee to get an appraisal and independent review appraisal by State qualified appraisers and review appraisers. In the past Original Assessed Values (OAVS) are used, as needed on special high priority projects. Please contact your Regional Office for additional guidance.

7. What is the difference between a change in acreage (decrease) and a (partial) disposal?

Change in acreage might occur if there was a data entry mistake in the deed, or a subsequent land survey reveals that the actual acreage differs from the original recorded survey data. A partial disposal occurs when a portion of a real property interest is sold or encumbered to another entity for some reason. A disposal (partial or full) generally does not require a grant action, but may in some circumstances. For example, a partial disposal of real property that occurs during the period of performance of the original acquisition award. In TRACS, users may adjust a real property record without the need for a grant action. To document a change in a real property record, we recommend that any adjustments should be made in coordination with the Regional Office real property specialist.

8. If the real property was a disposed do you map a new boundary, or the area that was disposed?

The location (i.e. polygon) for a parcel should always reflect the current area of the parcel. In the case of a partial disposal, the polygon should be adjusted to reflect the new total acreage. For example, a 50 acre polygon with 10 acres disposed should have its location edited to reflect the remaining 40 acre polygon.

9. What is the difference between easement, and lease/perpetual easement?

States should refer to the Service’s recently published Real Property Lands Chapters (520 FW 6) for definitions around real property.

An easement is a partial interest in a designated area of land owned by another entity. The holder of the easement may have the right to (1) use the land or the area above/below for a specific purpose, or (2) prevent specific uses of the land. An easement does not allow its holder to take anything from the land. Easements may be for a fixed period of time or may be perpetual. Under PR and DJ program awards, an easement is not considered an ownership interest in real property. As such, per 50 CFR 80.131, a State fish and wildlife may co-hold an easement with a subrecipient.

A lease is a contract in which the fee owner transfers to a lessee the right of exclusive possession and use of an area of land or water for a fixed period of time, which may be renewable. The lessor cannot readily revoke the lease at his or her discretion but must be able to regain possession of the lessee’s interest at the end of the lease term. The lessee pays rent periodically or as a single payment. Such agreements that do not correspond to this definition are not a lease, even if it is labeled one. Under PR and DJ program awards, a lease is considered an ownership interest in real property. As such, per 50 CFR 80.130, the State fish and wildlife agency, or the State must not co-hold a lease with a subrecipient.

10. Is there a place to attach the deed and other land documents sent into the regional office – for example the deed is held in perpetuity by the office. Could TRACS be used to store this centrally and electronically?TRACS has multiple places to add attachments, however we do not recommend attaching the deed and official land documents because they will likely have Personally Identifiable Information (PII) present. Housing PII in TRACS would require additional Federal approval requirements and security, so any files that include PII must be redacted before being uploaded as attachments in TRACS. Recipients should contact their Regional Office as to how best to include deeds and other documents pertaining to real property as part of the final reports and ensure that all required information is included in the Official Award File (GrantSolutions).

11. The Real Property Record has a place to associate it with a Wildlife Management Area (WMA), but does not have a place to associate other state areas (such as boating access sites, aquatic management sites, fishing areas, fish hatcheries, etc.) Is this something that could be added to the WMA drop down in the future?The “Associate with Wildlife Management Area (WMA)” field allows users to associate real property records with a WMA only, specifically if the land acquisition extends or includes the WMA boundary. Boating access sites, aquatic management areas, fishing areas and fish hatcheries are facility types and cannot currently be linked to a real property record. However, this capability may be added later and in the meantime facility locations can be overlayed with real property locations if necessary.

12. Is there a way to pull a report of real property records sorted/filtered by location?

The ‘Reports’ page, accessible from the Inventory dashboard, has a ‘Real Property’ report that lists real property records in the system. The report may be exported as an excel file and may be sorted/filtered by location (such as state or county). Note the Reports section is still under development so features, content, and data will continue to improve.

13. What are the mapping requirements for Real Property Records?The Real Property location page requires a mapped location (polygon or shapefile). Public Land Survey System (PLSS) location information is optional and may be entered if available. Additional info such as coordinates, location details, and attachments can be added to the optional 'Location Description' section.

14. If we subgrant funds and do not hold an interest in the property acquired, how should we show that in TRACS (such as holding a conservation easement only)?

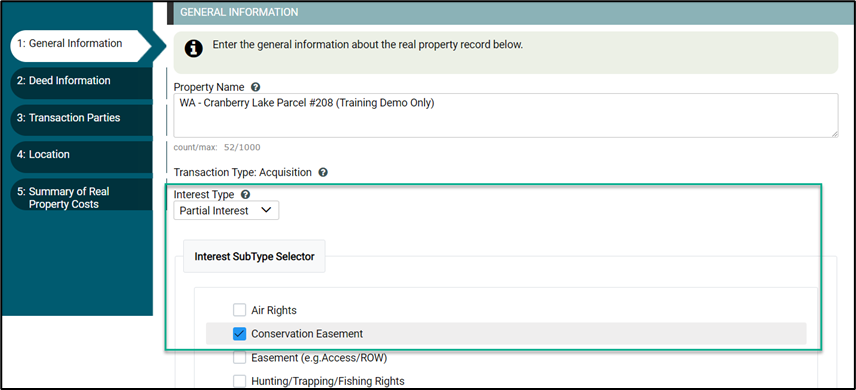

If your state agency does not hold interest in the real property acquired, such as holding a conservation easement, then select the interest type as “Partial Interest” and the Sub-type as “Conservation Easement”.

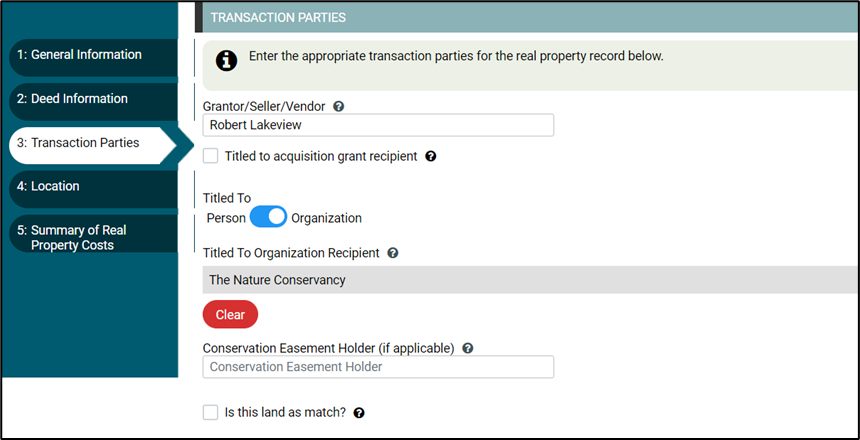

On the ‘Transaction Parties’ tab, you would not check the box for ‘Titled to acquisition grant recipient’ and add the subrecipient information in the ‘Titled To’ section for a person or organization, and if applicable, fill out the ‘Conservation Easement Holder’.

15. We currently track banked match on a spreadsheet, such as when a property appraises for more than the utilized match and the overmatch value can be “banked” to use for other projects. Could the Real Property Record ‘Summary of Real Property Costs’ page be updated to include a spot to store the banked match value? Also, if banked match from one project is applied to multiple projects, is there a way to store this information in TRACS?

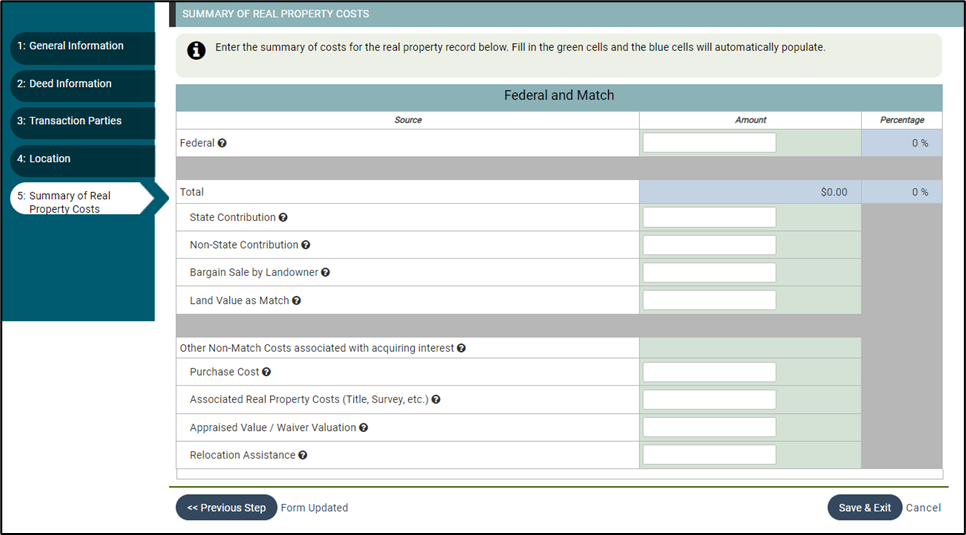

The TRACS ‘Summary of Real Property Costs’ page has a ‘Land Value as Match’ box for when you are contributing a parcel of land to be used as match for an acquisition.

TRACS does not have a ‘Banked Match Value’ box. This is outside of the scope of TRACS because typically ‘banked match’ is only applicable to parcels that the State purchased with no Federal nexus. Please consult with your Regional Office for guidance.

16. I have a grant that has been approved and is ready for reporting. I entered the real property record but I’m waiting for it to be approved so I can complete the performance report. Does the system have additional reminder emails/notifications to the Non-federal and Federal approvers?System generated email notifications are sent to Non-federal and Federal approvers when there is an approval workflow step that requires their attention (make sure to add the contacts to the record and toggle notifications to “yes”). However, the system does not currently send any additional reminders so please follow-up with your approval team if you are waiting for approvals to complete the performance report.